15 Apr COVID-19’s Short and Long Term Impact on Real Estate

While it’s clear that Coronavirus is having a dramatic impact on the real estate market right now, Zillow and housing economists don’t expect it to impact home prices in the long-term. In a study of the housing market during previous pandemics, they found that home sales dropped quickly during the outbreak but that home prices stayed about the same.

The housing market was on solid ground at the beginning of the year. Mortgage rates remained low and more buyers were expected to enter the market. The number of available homes for sale remained low, but sales began to grow to high levels in January. In February, the U.S saw a 7.2 percent gain in existing home sales and a 14.3 percent increase in new home sales from 2019. The drop in mortgage rates helped push a lead in to spring sales. Demand from buyers remained high and building confidence was at its peak. As COVID-19 became more serious, potential buyers and sellers became more cautious as the virus disrupted any initial decision to enter the market.

As expected, Zillow found that the economy drastically fell temporarily — a 5 to 10 percent, through previous epidemics like the SARS outbreak in 2003 and the 1918 Influenza epidemic. Interestingly enough, economic activity recovered quickly after each one ended. NOTE: This pattern differs from a standard recession. Usually, a recession sees economic activity fall for a year or so, before building back up at a slower pace.

The number of home sales dropped significantly during previous outbreaks (Zillow).

China did see a fall in monthly real estate transactions from 33 percent to 72 percent. This was only during the duration of the epidemic. Unemployment rose 1.3 percent but returned to normal in less than a year. During January and February of this year, the Real Capital Analytics showed that deal volume was down 50 percent from last year in Asia-Pacific. It’s still too early to tell, but as of now, the U.S. and Europe saw about an 18 percent decline but are still behind in the spread of the virus.

Home prices held steady or had only dropped slightly. Transactions returned to normal volumes after the epidemic was over (Zillow).

Early indications from China support this premise with housing prices remaining relatively stable from December to January and transaction volume decreasing during the COVID-19 outbreak.

So with a halting economy, will the housing sector follow?

In the short-term, springtime tends to be the busiest time for real estate with Sellers listing their homes, and Buyers entering the market. This usual boost will definitely be postponed. With fewer transactions, it’s hard for home prices to change significantly. Similar to previous epidemics, the housing sector is simply on pause.

Once coronavirus hit the states, spending habits changed, and people started to tighten their finances. This is mainly due to the social-distancing mandates, closures of businesses, and record-high unemployment rates. Within just 3 weeks with over16million people filed for unemployment claims.

Searches for ‘homes for sale’ have declined almost 40 percent in the last few weeks, according to portals like Zillow, Redfin, and LendingTree. This is an indicator of buying interest and behavior lessening since the start of the virus. On average, this search rate is close to a 90.3 value and could drop as low as 32.5. Below are the largest and smallest year-over-year decline in home searches by visual map.

It’s not just new interest entering the market but even current sales are experiencing delays in the process. Financing, inspections, walk-throughs, and other in-person meetings or communication between lenders, buyers, or brokers are put on hold. Any sales transactions already in place tend to take 30 to 45 days anyways for completion and hopefully will close towards the end of the virus. Thankfully, a decrease in closings hasn’t hit yet. Realtors do expect to see buying activity ‘rebound’ with a high demand for housing needed after the virus passes.

Sellers are also postponing their plans and pulling their listings off the market. There was a drop in new listings during the first week of April for a 31 percent year-over-year. It’s too much of a risk to have potential virus carriers in people’s homes, or to move during such an uncertain time or not have the sale go through — for multiple reasons. There is suspicion that home prices could increase with fewer homes on the market creating more of a limited inventory than before COVID-19 began.

Weekly mortgage applications saw a 17.9 percent drop, another indicator that the virus has scared off buyers. Mortgage rates have reflected economic change, which is a good sign. But not as many people can take advantage of the affordability leverage since they are limited to their homes. Legislation put forward mortgage relief programs to help borrowers, who have lost their job due to the coronavirus, to suspend their payments for up to a year. For lenders, low-interest rates brought high demand for refinancing, at a 168 percent increase in applications compared to 2019, during a time where forbearance requests are flooding in. This has created a major cash crunch in the industry and it has become harder for buyers to secure financing. Though the mortgage market is volatile, rates have held steady around 3.8 percent and are expected to move even lower later in 2020 as the market continues to heal.

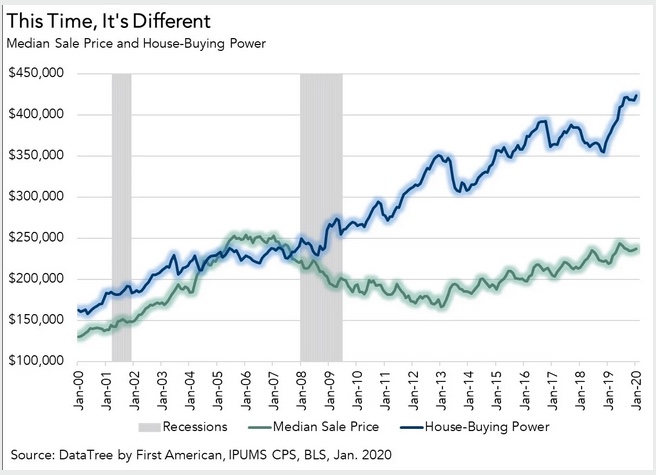

Housing experts state that shifts in the mortgage markets are to prevent forbearance. They doubt that the 2008 recession will repeat itself because there is not an oversupply of homes for sale with a scarcity of buyers. Mark Fleming, chief economist of First American Financial Corporation states that this graph shows the house-buying power is much higher today than the median sale price of a home; showing that the housing is not overvalued. It is in a much better position during this downturn than it was in the 2008 to 2009 time period.

In conclusion, Fleming comments: “The housing market will not go unscathed, as consumer confidence and a strong labor market are essential in the decision to purchase a home, yet, this time, housing is a casualty of a public health crisis turned economic, not the cause of an economic crisis.”

With fewer transactions during the pandemic, home prices are less likely to see major changes. Official data of sales won’t show any direct effects for another 1 or 2 months. In some regions, home prices could even see a decline.

Knowing that inventory was very low before the pandemic and homebuilding supply lines are experiencing delays (1/3 comes from China according to the NAHB), experts believe that home values will show surprising stability. New homes mean more new home sales. With the virus interrupting new construction, the pace is certain to slow in the short term. Home builder confidence hit its highest levels at the beginning of the year, however, and there was a spike in construction starts. Builders are more inclined to continue the construction of new homes once the pandemic settles and supplies become more available.

In the coming months, housing supply could see challenges in the long run. Especially, if interest rates remain low in support of buying demands and the economy takes longer to build back up. The upside to this — buyers would have less competition in the bidding wars.

As the market dropped, investors began to look for security. Single-Family rental properties may see the most positive long-term affect. These types of units saw a spike in online searches from global investors as our society sees potential shifts for a more ‘at-home’ working environment. They find more opportunities in larger rentals that accommodate multiple people working from a home office.

Real Estate isn’t generally tied to the shifts in the stock market. It is a good, more stable, investment and unlike a stocks investment, it is a basic need that does not completely stop — even during something like COVID-19.

The overall effects on real estate will differ between each region and city. Some states have considered Real Estate essential, while others have stricter limitations. With stay-at-home, and social distancing is highly encouraged or mandated, virtual resources and digital tools are being used more than ever and are reliable to keep transactions progressing. It also depends on how long or how hard the pandemic will hit in certain areas and how quickly the economic stature can return to normal.

The changes with COVID-19 are fluid and showing up daily, if not hourly. As the virus worsens, or mandates become more serious, the impact on the industry may continue to grow. What’s important to remember is real estate and mortgage experts and professionals are still working for you. Whether you’re a buyer, seller, or investor, the industry has adjusted to alternate and efficient ways to process transactions and are prepared for what is to come. Reach out if you need more support or have any questions.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like Zillow, Forbes, Lending Tree, and Yahoo Finance.