10 Dec The FHFA and FHA Set New Increasing Loan Limits for 2021

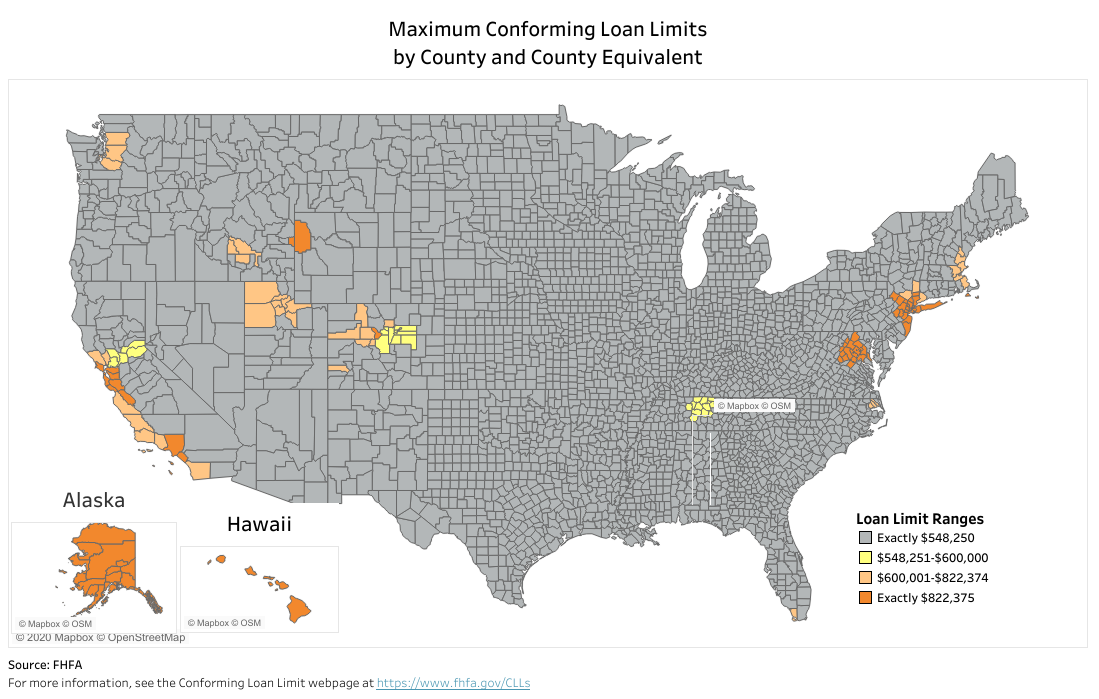

For the fifth year in a row, the Federal Housing Finance Agency (FHFA) released a new maximum for conforming loan limits on mortgages that will be acquired by Fannie Mae and Freddie Mac in 2021. Starting January 1st, the new baseline is $548,250 for one-unit properties – an average increase of 7.42 percent, or $37,850 higher than 2020’s limit of $510,400.

High-cost areas will increase to $822,375 for one-unit properties, which is almost a $57,000 jump from the limit of $765,600 set just last year. The new number sets a ceiling, giving room, or 150 percent more of the baseline, for the higher cost of living for buyers in that area.

For example, cities like Boulder and San Diego are in the mid-range at $753,250 and $654,350. Coastal city areas such as Los Angeles and New York City counties will set at the maximum of $822,375. It varies across the country – all but 18 counties will rise to the new $548,250 limit.

You can click here to view a map and find your local county limit.

Similar to last year, the Federal Housing Agency (FHA) followed close behind and announced that the 2021 loan limit is increasing by almost $25,000. The gain is due to the continuously moderate rise of home values annually, pressured by lack of inventory and the low mortgage rates.

The change is no big surprise, given that home prices continue to grow at a moderate pace. According to the S&P CoreLogic Case-Shiller Home Prices Index (HPI), home prices saw the largest gain since 2014 at seven percent, compared to last year. The HPI states this is nearly 23 percent higher than its peak in 2006.

“The price jumps reported in the Case-Shiller Index roughly matched up with statistics from the Federal Housing Finance Administration, which reported that prices increased 3.1% over the second quarter, the biggest gain since at least 1991 when the agency began keeping records.”

“Though home prices continued to rise in September, homebuyers showed little interest in slowing down, driving existing home sales up for the fifth consecutive month in October, 4.3% year-over-year.”

Why is this good news for you? The new limit allows a larger group of borrowers to take advantage of more room to buy a home with a conforming loan and not a jumbo loan. To find the right mortgage, it can take some shopping around when taking out a jumbo loan. It can also have more approval requirements and make a significant difference with interest rates. Borrowers can take out a larger loan and afford more house.

General home affordability has been harder to grasp for a lot of prospective buyers. The new loan limit provides more mortgage lender options while making it easier to qualify for a loan at a lower rate.

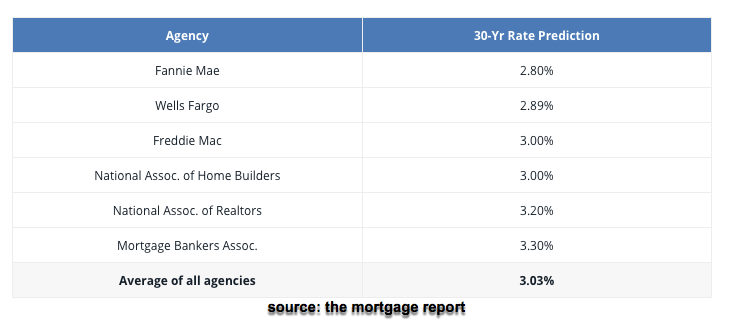

The new loan limit also offers the chance to save more money! Industry professionals expect interest rates to stay around three percent. Those wanting to take advantage of the new loan limits and the low rates could save thousands on a mortgage.

Whether you want to refinance, make a new home purchase, or bring your payment down, this may be the perfect opportunity to kick off the new year for buyers, sellers, and homeowners.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like FHFA, FHA, HousingWire.